Industry Readout: Bankers Report Mixed 2026 Bonuses Across Firms and Desks

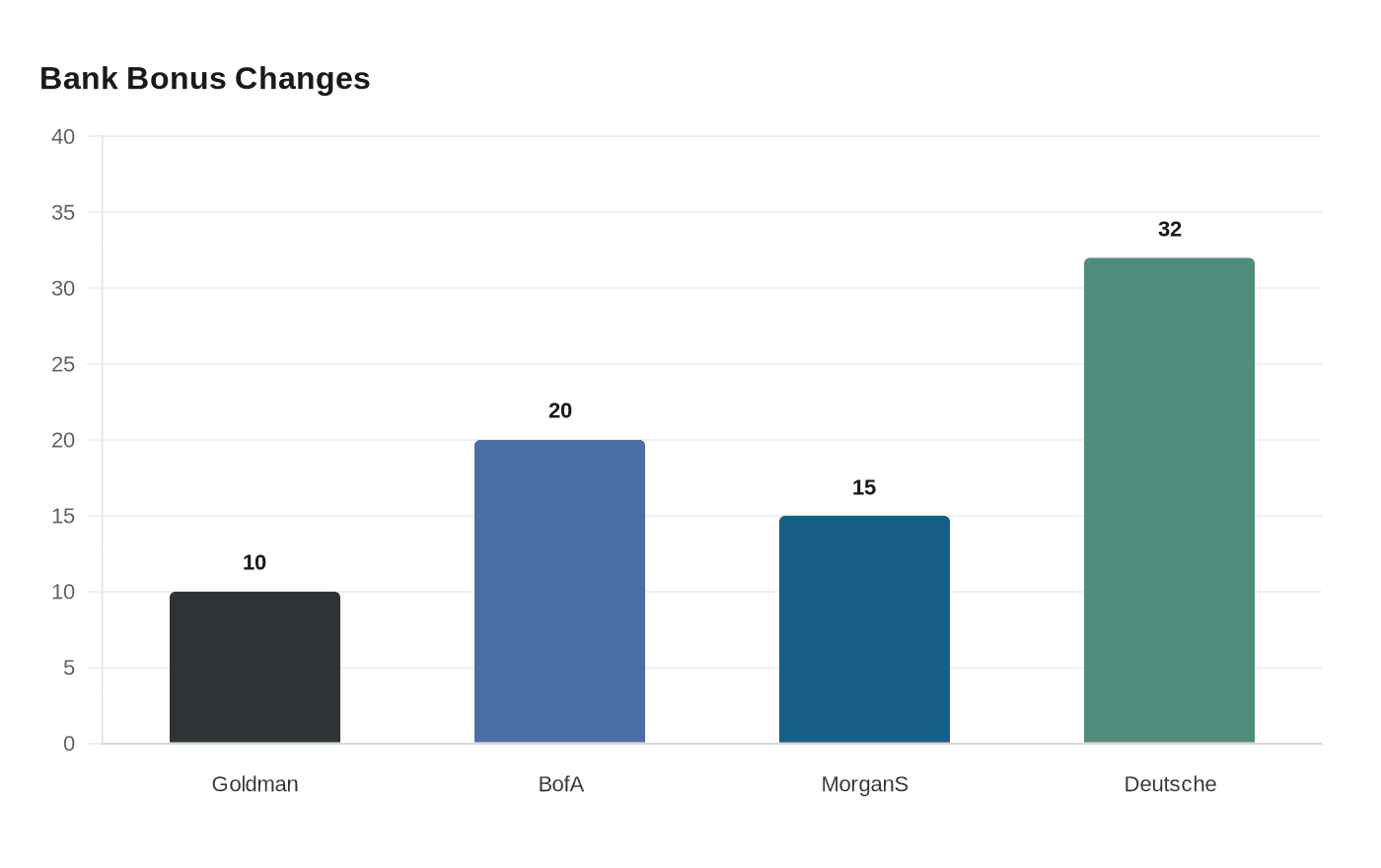

Goldman’s pool rose about 10%, but a senior technologist said engineering and operations bonuses were "hit badly"; Bank of America flagged +20% for some investment bankers.

An industry round‑up published in mid‑February 2026 shows a patchwork 2026 bonus season, with Goldman Sachs reporting a roughly 10% larger overall pool while other banks delivered divergent outcomes by desk and region. Bloomberg’s summary that "the pool at Goldman was 10% higher" sits alongside internal color that front‑office bankers are largely content while middle and back office staff are "ambivalent‑to‑sad," and one senior technologist at Goldman said engineering and operations bonuses were "hit badly" in what sources described as a possible retention‑sorting move.

Bank‑by‑bank numbers were uneven. Bank of America intended to increase bonuses by 20% for its investment bankers, a December note showed, with Asia‑based bonuses thought to have come closest to that approximation and markets bonuses believed to have risen by less. Morgan Stanley raised London banker payouts by up to 15% in late January, and Deutsche Bank has held off on announcing 2026 figures until March; Deutsche Bank paid material risk takers average bonuses of $1.1m last year and its investment banker and trader bonus pool rose 32% in that reference year.

Citi displayed internal segmentation between senior dealmakers and markets staff. The firm invited material risk takers in London to sign contracts locking smaller salaries in exchange for larger, variable bonuses, and Financial News coverage showed some London bankers received 10–15% uplifts while others got 20%. At the same time, markets traders at Citi complained of being zeroed or having bonuses halved amid job cuts and "suggestions that swathes of people were intentionally disappointed in the hope that they might leave of their own accords."

Product and regional patterns tracked pre‑holiday forecasts and November estimates from Johnson Associates. Alan Johnson said advisory roles generally received a 10–15% uplift, with some reaching 20%, and warned that "those getting squeezed will be the people in the middle." Johnson added that "people have amnesia" about early‑year market weakness despite strong late‑year results. Ifre’s November‑reported Johnson Associates ranges for 2025 showed equities up 15–25%, FICC 5–15%, DCM 5–15%, ECM 5–8% and M&A 10–15%, while a LinkedIn analysis flagged Europe as cautious - most senior bankers preparing for flat to +5% - and the U.S. as expecting +5% to +15% typical movement.

Morale and mobility implications were prominent in the round‑up. eFinancialCareers captured complaints in EMEA equities and equity research that teams exceeded budgets in September yet received only "a few percentage points" increases. Ifre noted that the whisper markets would subsidize investment banking "doesn’t look like that is happening" and highlighted fierce competition to retain hedge fund account managers, traders, quants and technologists amid hiring by short‑term trading hedge funds and electronic prop shops. WallStreetOasis forum posts offered granular color, including a vice president in sales and trading reporting a $275k base and a $500k bonus, with peers replying that "judging from what we're hearing out there this is excellent total number for a senior VP/Director level?"

The mixed readout leaves Deutsche Bank’s March announcement as the next formal data point and places first‑half 2026 hiring and boutique recruiting in sharper focus. The round‑up’s synthesis of Bloomberg, eFinancialCareers, Ifre, Johnson Associates and forum color suggests banks are calibrating pay by geography, product and seniority rather than restoring a uniform across‑the‑board uplift.

Know something we missed? Have a correction or additional information?

Submit a Tip